World

CLONE ACCOUNTING CAPITAL > World > Differences > What is the difference between Profit and Loss & Profit and Loss Appropriation Account?

What is the difference between Profit and Loss & Profit and Loss Appropriation Account?

- October 22, 2017

- Posted by: Ahuja Sahil

- Category: Differences

No Comments

Profit and Loss Vs Profit and Loss Appropriation Account

Profit and loss appropriation account is an extension of the profit and loss account itself, however, there is a fundamental difference between profit and loss & profit and loss appropriation account.

By definition, a P&L account or Income statement is one of the three financial statements of an organization which summarizes revenues and expenses to ascertain net profit or a net loss of the organization for a specific time period.

By definition, a P&L appropriation account is used to demonstrate the division or allocation of profit/losses among the owners.

| Basis | Profit and Loss Account | Profit and Loss Appropriation Account |

| Purpose | P&L account is used to determine the Net Profit or Net Loss of an organization for a given accounting period. | P&L appropriation account is used for the allocation and distribution of Net Profit among partners, reserves and dividends. |

| Made by | P&L account is prepared by all types of businesses. | P&L appropriation account is prepared mainly by partnership firms. |

| Balances | Profit and loss account don’t have any opening or closing balance as it is prepared for a specific accounting period. | The profit and loss appropriation account may have carried forward balance from the previous accounting period. |

| Timing | It is prepared after the trading account. | It is made after the preparation of the profit and loss account. |

| Nature | Items debited are all expenses (charged against profit) | Items debited are all appropriations of profit. (how profit is divided) |

| Partnership | Preparation of P&L account is not based on a partnership agreement (exception – interest on a loan from partners) | The preparation of P&L account is based on a partnership agreement. |

| Principle | The matching principle is followed i.e. expenses for an accounting period are matched against related incomes. | The matching principle is not followed while preparing a P&L appropriation account. |

Related Topic- What are Balance Sheet Accounts?

Format of Both Accounts

Format of P&L account

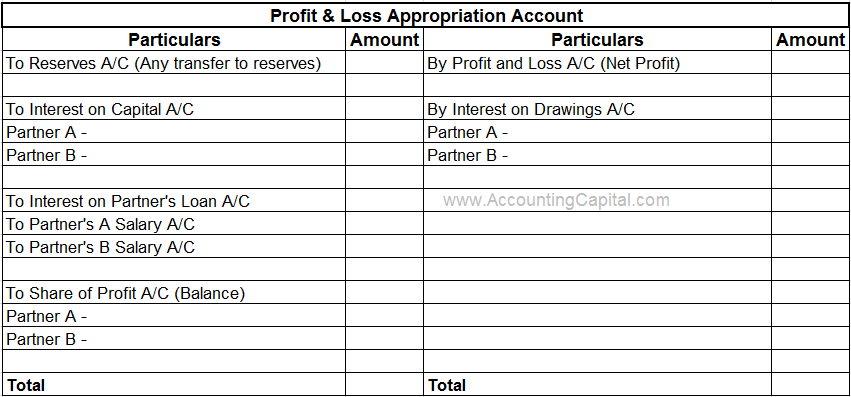

Format of P&L Appropriation account (partnership)

Author:ahujasahil(test)

He is the Founder of AccountingCapital.com with a single aim i.e. to "Simplify Accounting and Finance". Sahil holds a Bachelors in Commerce and a Masters in Finance. He loves whiteboard explanations, helping others, and travelling. Sahil's corporate experience extends over 6 yrs with eminent names such as Ameriprise Financial & AXA Insurance.