World

What is the Journal Entry for Credit Purchase and Cash Purchase?

- March 2, 2018

- Posted by: Ahuja Sahil

- Category: Journal Entries

Journal Entry for Credit Purchase and Cash Purchase

To run successful operations a business needs to purchase raw material and manage its stock optimally throughout its operational cycle. Accounting and journal entry for credit purchase includes 2 accounts, Creditor and Purchase. In case of a journal entry for cash purchase, ‘Cash’ account and ‘Purchase‘ account are used.

The person to whom the money is owed is called a “Creditor” and the amount owed is a current liability for the company. Purchase orders are commonly used in large corporations to order goods on credit.

Accounting and Journal Entry for Credit Purchase

In case of a credit purchase, “Purchase account” is debited, whereas, the “Creditor’s account” is credited with the equal amount.

| Purchase Account | Debit |

| To Creditor’s Account | Credit |

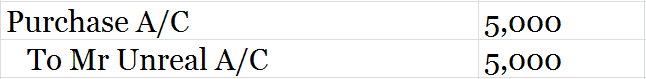

Journal entry for credit purchase

Golden rules of accounting applied (UK Style)

- Purchase A/C (Type – Nominal) > Rule – Dr. all Expenses and Losses

- Creditor’s A/C (Type – Personal) > Rule – Cr. the Giver

Modern rules of accounting applied (US-Style)

- Purchase A/C (Type – Expense) > Rule – Dr. the Increase in Expenses

- Creditor’s A/C (Type – Liability) > Rule – Cr. the Increase in Liability

Example – Journal Entry for Credit Purchase

Post a journal entry for – Goods purchased for 5,000 on credit from Mr Unreal

Related Topic – Journal Entry for Credit Sales and Cash Sales

Accounting and Journal Entry for Cash Purchase

Cash Purchase, on the other hand, is simple and easy to account for. In case of cash Purchase, the “Purchase account” is debited, whereas “Cash account” is credited with the equal amount.

| Purchase Account | Debit |

| To Cash Account | Credit |

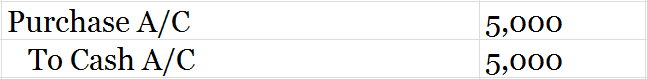

Journal entry for cash purchase

Golden Rules applied (UK Style)

- Purchase A/C (Type – Nominal) > Rule – Dr. all Expenses and Losses

- Cash’s A/C (Type – Real) > Rule – Cr. What Goes out

Modern Rules applied (US-Style)

- Purchase A/C (Type – Expense) > Rule – Dr. the Increase in Expenses

- Cash A/C (Type – Asset) > Rule – Cr. the Decrease in Asset

Example – Journal Entry for Cash Purchase

Post a journal entry for – Goods purchased for 5,000 in cash from Mr Unreal

Short Quiz for Self-Evaluation

Your quiz has been submitted

Want to re-attempt? - Plz “Refresh” this page.

Error? - contact@accountingcapital.com.

Subscribed? - Plz, check your mailbox.

Thank You!!

We faced problems while connecting to the server or receiving data from the server. Please wait for a few seconds and try again.

If the problem persists, then check your internet connectivity. If all other sites open fine, then please contact the administrator of this website with the following information.

TextStatus: undefined

HTTP Error: undefined

Some error has occured.

>Read Cash Discount