World

Accounting and Journal Entry for Sales Returns

- August 24, 2019

- Posted by: Ahuja Sahil

- Category: Journal Entries

Journal Entry for Sales Returns or Return Inwards

Sometimes due to various reasons goods sold by a company may be returned by the respective buyer(s). This may happen due to several different reasons, in business terminology, this action is termed a sales return or return inwards. Journal entry for sales returns or return inwards is explained further in this article.

Accounting events related to goods being returned are documented in the final accounts as they have a monetary impact on the financial statements of a company. Depending on the terms and conditions of the transaction goods sold in credit may be returned.

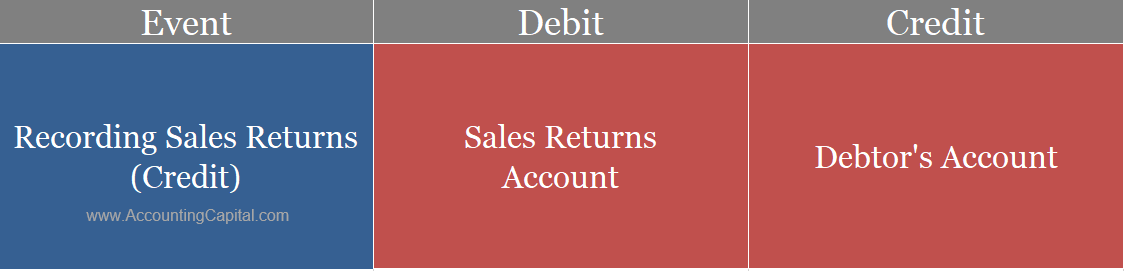

Journal Entry for Sales Returns or Return inwards (in Credit)

| Sales Returns Account | Debit | Debit the decrease in revenue |

| To Debtor’s Account | Credit | Credit the decrease in asset |

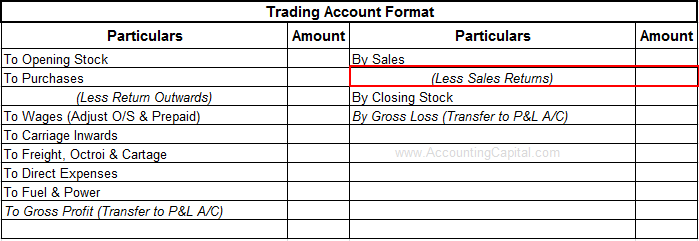

Treatment of Sales Returns in the Financial Statements

Return inwards or sales returns are shown in the trading account as an adjustment (reduction) from the total sales for an accounting period.

It is not shown in the income statement or the balance sheet.

Related Topic – What is the Accounting Cycle?

Example – Journal Entry for Sales Returns

Unreal Corporation sold raw materials worth 10,000 on credit to ABC Corporation. However, at the time of delivery, ABC Corporation found goods worth 2,000 as unfit because they were damaged in transit.

These goods were returned by ABC Corporation. Post an accounting entry for sales returns in the books of Unreal Corporation.

Journal entry for sales returns in the books of Unreal Corporation

| Sales Returns Account | 2,000 |

| To ABC Corporation | 2,000 |

The two accounts involved in this entry are the “Sales Return account” and the “ABC Corporation” (Debtor’s) account.

As per the three types of accounts in bookkeeping;

| Sales Returns Account | Nominal | Debit | Debit all expenses and losses |

| ABC Corporation | Personal | Credit | Credit the giver |

Sales return isn’t exactly an expense or a loss to the company, however, it reduces current assets (in the case of credit sales), and therefore, it indirectly acts as a loss.

Short Quiz for Self-Evaluation

Your quiz has been submitted

Want to re-attempt? - Simply “refresh” this page.

Please check out more content on our site :)

Subscribed? - Check your mailbox

Thank You!

We faced problems while connecting to the server or receiving data from the server. Please wait for a few seconds and try again.

If the problem persists, then check your internet connectivity. If all other sites open fine, then please contact the administrator of this website with the following information.

TextStatus: undefined

HTTP Error: undefined

Some error has occured.

Revision & Highlights Short Video

Highly Recommended!!

Do not miss our 1-minute revision video. This will help you quickly revise and memorize the topic forever. Try it :)

>Read Accounting and Journal Entry for Purchase Returns