World

What is Fixed Assets Ratio?

- November 21, 2017

- Posted by: Ahuja Sahil

- Category: Ratios

Fixed Assets Ratio

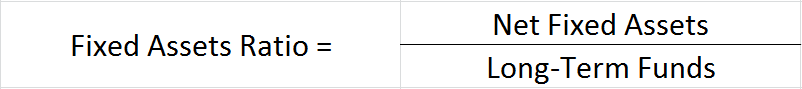

The fixed Assets ratio is a type of solvency ratio (long-term solvency) which is found by dividing the total fixed assets (net) of a company by its long-term funds. It shows the amount of fixed assets being financed by each unit of long-term funds.

It helps to determine the capacity of a company to discharge its obligations towards long-term lenders indicating its financial strength and ensuring its long-term survival.

Formula to Calculate Fixed Assets Ratio

Net fixed assets: (Total of fixed assets – Total depreciation till date) + Trade Investments including shares in subsidiaries.

Long-term funds: Share capital + Reserves + Long-term loans.

Explanation with an Example

From the balance sheet of Unreal corporation calculate its fixed assets ratio;

| Liabilities | Amt | Assets | Amt |

| Share Capital | 2,00,000 | Plant & Machinery | 1,90,000 |

| Reserves & Surplus | 40,000 | Furniture | 10,000 |

| Short-Term Loans | 25,000 | Inventories | 60,000 |

| Trade Payable | 25,000 | Trade Receivable | 30,000 |

| Expense Payable | 10,000 | Short-Term Investment | 10,000 |

| Total | 3,00,000 | Total | 3,00,000 |

From the above balance sheet (considering nil depreciation)

Net Fixed Assets = Plant & Machinery + Furniture

= 1,90,000 + 10,000

= 2,00,000

Long-Term funds = Share Capital + Reserves + Long-Term Loans

= 2,00,000 + 40,000

= 2,40,000

Fixed Assets Ratio = 2,00,000/2,40,000

= 0.83

This shows that for 1 currency unit of the long-term fund, the company has 0.83 corresponding units of fixed assets; furthermore, the ideal ratio is said to be around 0.67.

High and Low Fixed Assets Ratio

Ideally, fixed assets should be sourced from long-term funds & current assets should be from short-term funds/current liabilities.

High – A ratio of more than 1 indicates net fixed assets of the company are more than its long-term funds which demonstrate that the company has bought some of its fixed assets with the help of short-term funds. This depicts operational inefficiency.

Low – A ratio of less than 1 indicates long-term funds of the company are more than its net fixed assets It is desirable to some extent as it means that a company has sufficient long-term funds to cover its fixed assets.

Short Quiz for Self-Evaluation

Your quiz has been submitted

Want to re-attempt? - “Refresh” this page.

Check out more content on our site :)

Subscribed? - Check your mailbox

Thank You!

We faced problems while connecting to the server or receiving data from the server. Please wait for a few seconds and try again.

If the problem persists, then check your internet connectivity. If all other sites open fine, then please contact the administrator of this website with the following information.

TextStatus: undefined

HTTP Error: undefined

Some error has occured.

>Related Long Quiz for Practice Quiz 35 – Fixed Assets

>Read What is Interest Coverage Ratio?