World

What is Debt to Equity Ratio?

- March 27, 2016

- Posted by: Ahuja Sahil

- Category: Ratios

Debt to Equity Ratio

Debt to equity ratio shows the relationship between a company’s total debt with its owner’s capital. It reflects the comparative claims of creditors and shareholders against the total assets of the company. It is a measurement of how much the creditors have committed to the company versus what the shareholders have committed.

Normally, the debt component includes long-term borrowings & long-term provisions, the equity component consists of net worth and preference shares not redeemable in one year.

If the purpose of calculating debt to equity ratio is to examine the financial solvency of a firm in terms of its ability to avoid financial risk, preference capital should be added to equity capital, however, if the intention is to show the effect of the use of fixed interest/dividend sources of funds w.r.t earnings available to ordinary shareholders then preference capital should be added to the debt.

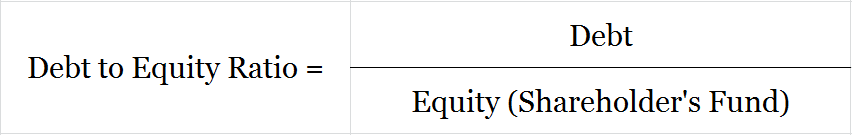

Formula to Calculate Debt to Equity Ratio

Total Debt: Includes both long-term debt & long-term provisions

Equity (S/H Fund): Share Capital + Reserves & Surplus

Example of Debt to Equity Ratio

From the balance sheet of Unreal corporation calculate its debt to equity ratio

| Liabilities | Amt | Assets | Amt |

| Share Capital | 2,00,000 | Tangible Assets | 80,000 |

| Reserves & Surplus | 40,000 | Intangible Assets | 1,40,000 |

| Long-Term Borrowings | 40,000 | Current Assets | 1,20,000 |

| Long-Term Provisions | 20,000 | ||

| Current Liabilities | 40,000 | ||

| Total | 3,40,000 | Total | 3,40,000 |

Total Debt = Long-Term Borrowings + Long-Term Provisions

Equity (S/H Funds) = Share Capital + Reserves & Surplus

Debt/Equity = (40,000 + 20,000)/(2,00,000 + 40,000)

= 60,000/2,40,000

Debt to Equity Ratio = 0.25

A debt to equity ratio of 0.25 shows that the company has 0.25 units of long-term debt for each unit of owner’s capital.

High & Low Debt to Equity Ratio

This ratio indicates the relative proportions of capital contribution by creditors and shareholders. It is used as a screening device in financial analysis. A lower percentage shows that the company is less dependent on borrowed money from outside parties, or in other words, has less debt as compared to its total shareholder’s funds, this is a favourable situation for external parties since they enjoy a higher safety margin.

A higher percentage on the other hand shows that the company depends a lot on its debt (borrowed funds + money owed to others) as compared to its shareholder’s funds, this puts external parties at a higher risk. Generally, well-established companies can push their debt component to higher percentages without getting into financial trouble.

In general, felt by the lenders. One of the limitations of this ratio is that the computation is based on book value, as it is sometimes useful to calculate these ratios using market values.

Short Quiz for Self-Evaluation

Your quiz has been submitted

Want to re-attempt? - “Refresh” this page.

Check out more content on our site :)

Subscribed? - Check your mailbox

Thank You!

We faced problems while connecting to the server or receiving data from the server. Please wait for a few seconds and try again.

If the problem persists, then check your internet connectivity. If all other sites open fine, then please contact the administrator of this website with the following information.

TextStatus: undefined

HTTP Error: undefined

Some error has occured.

>Read What is Debt to Asset Ratio?