World

What is Proprietary Ratio?

- April 10, 2016

- Posted by: Ahuja Sahil

- Category: Ratios

Proprietary Ratio

This ratio shows the proportion of total assets of a company which are financed by proprietors’ funds. The proprietary ratio is also known as the equity ratio. It helps to determine the financial strength of a company & is useful for creditors to assess the ratio of shareholders’ funds employed out of the total assets of the company.

The word “Proprietors” is a synonym for “owners of a business”, proprietors’ funds, in this case, would only be the funds which belong to the owners/shareholders of the business. Proprietors’ funds are also known as Owners’ funds, Shareholders’ funds, Net Worth, etc.

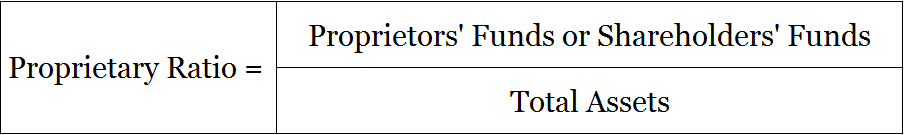

Formula to Calculate Proprietary Ratio

Proprietors’ funds or Shareholders’ funds = Share Capital + Reserves and Surplus

Total Assets = Includes total assets as per the balance sheet

Related Topic – Debt to Equity Ratio

Example of Proprietary Ratio

From the balance sheet of Unreal Corporation calculate its proprietary ratio

| Liabilities | Amt | Assets | Amt |

| Share Capital | 10,00,000 | Tangible Assets | 10,00,000 |

| Reserves & Surplus | 2,00,000 | Long-Term Investments | 5,00,000 |

| Short-Term Borrowings | 40,000 | Stock | 70,000 |

| Trade Payable | 4,00,000 | Trade Receivable | 70,000 |

| Total | 16,40,000 | Total | 16,40,000 |

Shareholders’ Funds/Total Assets

S/H Funds = 10,00,000 + 2,00,000

Total Assets = 16,40,000

12,00,000/16,40,000

Proprietary ratio = 0.73

A proprietary ratio of 0.73 shows that the company has 0.73 units of shareholders’ funds for each unit of total assets or in other words, 73% of the total assets of the company are financed by proprietors’ funds.

High & Low Proprietary Ratio

High – This ratio indicates the relative proportions of capital contribution by shareholders in comparison to the total assets of a company. It is used as a screening device for financial analysis, a higher ratio, say more than 75% means sufficient comfort for creditors since it points towards lesser dependence on external sources.

Low – Whereas, a lower ratio, say less than 60% means discomfort for creditors since it shows more dependence on external sources, a lower ratio can be seen as a threat and may increase the unwillingness of creditors to extend credit to the company. A company should mix and balance its external and internal sources in a way that none of them is too high in comparison to the other.

Short Quiz for Self-Evaluation

Your quiz has been submitted

Want to re-attempt? - “Refresh” this page.

Check out more content on our site :)

Subscribed? - Check your mailbox

Thank You!

We faced problems while connecting to the server or receiving data from the server. Please wait for a few seconds and try again.

If the problem persists, then check your internet connectivity. If all other sites open fine, then please contact the administrator of this website with the following information.

TextStatus: undefined

HTTP Error: undefined

Some error has occured.

>Read Stock Turnover Ratio