World

What is Super Quick Ratio?

- January 19, 2016

- Posted by: Ahuja Sahil

- Category: Ratios

Super Quick Ratio or Cash Ratio

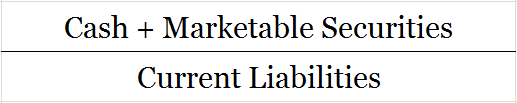

This ratio goes one step ahead of current ratio, liquid ratio & is calculated by dividing super quick assets by the current liabilities of a business. It is called super quick or cash ratio because unlike other liquidity ratios it only takes into account “super quick assets”. This is the most stringent test of a business’ current liquidity situation.

Super quick assets strictly include cash & marketable securities (since they can almost instantly be converted to cash)

Current liabilities would include overdraft, creditors, short-term loans, outstanding expenses, etc.

Formula to Calculate Super Quick or Cash ratio

Example of Super Quick or Cash Ratio

Unreal corp. has submitted the below information regarding their current assets and current liabilities, calculate their super quick ratio.

| Current Assets | Amt | Current Liabilities | Amt |

| Cash & Equivalents | 20,000 | Outstanding Expenses | 15,000 |

| Marketable Securities | 150,000 | Provision for Expenses | 10,000 |

| Inventories | 40,000 | Creditors | 20,000 |

| Debtors | 25,000 | Bills Payable | 15,000 |

| B/R | 5,000 | ||

| Total | 2,40,000 | Total | 60,000 |

Calculation:

Super Quick Assets/Current Liabilities

(Cash + Marketable Securities)/Current Liabilities

= (20,000 + 150,000)/60,000

= 1,70,000/60,000

= 2.833

Higher the super quick ratio better the liquidity condition of a business. In the above case for every 1 unit of current liability, the company has 2.833 units of super quick assets, which is good.

Short Quiz for Self-Evaluation

Your quiz has been submitted

Want to re-attempt? - “Refresh” this page.

Check out more content on our site :)

Subscribed? - Check your mailbox

Thank You!

We faced problems while connecting to the server or receiving data from the server. Please wait for a few seconds and try again.

If the problem persists, then check your internet connectivity. If all other sites open fine, then please contact the administrator of this website with the following information.

TextStatus: undefined

HTTP Error: undefined

Some error has occured.

>Read What is Operating Cash Flow Ratio?