World

Difference Between Ledger and Trial Balance Although ledger and trial balance are both integral parts of the same accounting cycle, there is still a considerable difference between ledger and trial balance. They both have their respective relevance and timing in the business cycle. In short, a ledger is an account wise summary of all monetary transactions, whereas a […]

Carriage Inwards Vs Carriage Outwards Carriage inwards and carriage outwards are two different types of expenses incurred by a company while buying and selling goods. They may be treated alike inside a trial balance, however, there is a clear difference between carriage inwards and carriage outwards. One is charged when the goods are being procured […]

Treatment of Carriage Outwards and Carriage Inwards in Trial Balance The trial balance is a statement of Dr. & Cr. balances which are extracted from ledger accounts after balancing them. It is prepared to prove that the total of accounts with a debit balance is equal to the total of accounts with a credit balance in […]

Journal Entry for Carriage Outwards Carriage outwards is essentially the delivery expense related to selling of goods. Usually it is an expense for the seller and is charged as a revenue expenditure with the help of a journal entry for carriage outwards. The product may or may not be for resale, the word “Outwards” shows […]

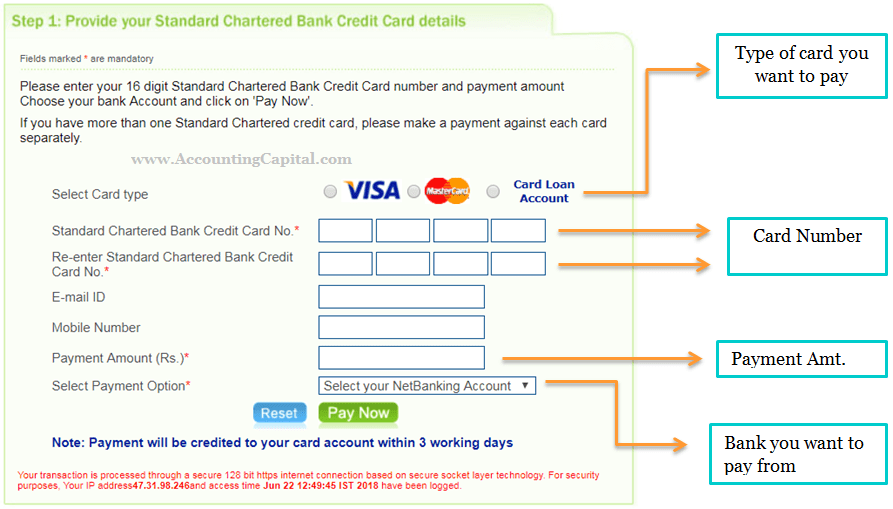

Pay Your Credit Card Bill From Another Bank Are you still old-fashioned when it comes to paying your credit card bills? Visiting the bank and waiting in queues? Well, you’re due for an upgrade and this article explains how you can pay your credit card bill from another bank using net banking. It is advisable […]

Journal Entry for Carriage Inwards Carriage inwards is the freight and carrying cost incurred by a business while acquiring a new product. Journal entry for carriage inwards depends on the item and the intent behind its usage. The product may or may not be for resale, the word “Inwards” shows that the cost is incurred while […]

Carriage Inwards and Carriage Outwards “Carriage” can be seen as freight or transportation cost, it is the carrying costs related to the purchase and sale of goods. Often the buyer is responsible for the cost of carriage inwards whereas the seller is responsible for carriage outwards. Carriage inwards and carriage outwards are essentially delivery expenses […]

Notes to Accounts Also known notes to financial statements, footnotes, notes to accounts are supporting information that is usually provided along with a company’s final accounts or financial statements. Many such notes are required to be provided by law, including details related to provisions, reserves, depreciation, investments, inventory, share capital, employee benefits, contingencies, etc. Other […]

Prepaid Expenses At times, during business operations, a payment made for an expense may belong fully or partially to the upcoming accounting period. Such a payment (partly or fully) is treated as a prepaid expense (unexpired expense) for the current period. It is treated as an adjustment in the financial statements and this article will describe the treatment […]

Overcapitalization It is a financial situation where a company has more than enough total capital as compared to the needs of its business operations. In case of overcapitalization, the total equity (owner’s capital + debt) of a company exceeds the actual worth of its assets. An overcapitalized company may often be burdened by interest payments or […]

Undercapitalization It is a financial situation where a company doesn’t have enough capital or reserves as compared to the size of its operations. Undercapitalization is often seen with new companies, it is a result of inadequate planning of funds for future growth. Even larger corporations with struggling operations and huge debts may be undercapitalized. An […]

Off-Balance Sheet (OBS) Also known as Off-Balance sheet items, Off-Balance sheet assets or liabilities, and Incognito Leverage. They are either a liability or an asset which are not shown on a company’s balance sheet as the business is not a legal owner of the respective item. Off-Balance sheet items are generally shown in the notes to […]

Net Profit Ratio Also known as Net Profit Margin ratio, it establishes a relationship between net profit earned and net revenue generated from operations (net sales). Net profit ratio is a profitability ratio which is expressed as a percentage hence it is multiplied by 100. Net sales include both Cash and Credit Sales, on the other […]

Gross Profit Ratio Also known as the Gross Profit Margin ratio, it establishes a relationship between gross profit earned and net revenue generated from operations (net sales). The gross profit ratio is a profitability ratio expressed as a percentage hence it is multiplied by 100. Net sales consider both Cash and Credit Sales, on the […]

Difference Between Journal Entry and Journal Posting Journal entry is recorded in a journal which is also known as the primary book of accounts, this is where all transactions are recorded for the first time in a progressive order. The words are often used around each other, however, there is a difference between journal entry and […]

Depreciation Vs Depletion Vs Amortization All assets with an estimated useful life eventually end up being exhausted. Different types of assets such as fixed, intangible & mineral assets are systematically reduced within their useful life. The difference between depreciation, depletion and amortization depends on the type of asset in question. Depreciation, Depletion and Amortization are three […]

Depletion It is a systematic reduction in the value of a natural resource as an asset. In accounting, depletion is mainly associated with the extraction of natural resources i.e. mineral assets. For example – extraction of coal from a mine, extraction of limestone from a quarry, unearthing oil from an oil well, etc. The cost […]

Offset Account To understand an offset account it is important to understand the meaning of the word “Offset”. It means, to show a consideration or amount that reduces or balances the effect of an opposite amount, it has an equal and opposite effect. In simpler terms, offset means a counteracting or opposite force. Example – […]

Closing Stock Goods that remain unsold at the end of an accounting period are known as closing stock. They are valued at the end of an accounting year and shown on the credit side of a trading account and the asset side of a balance sheet. Accounting and journal entry for closing stock is posted […]

Journal Entry for Income Tax Income tax is a form of tax levied by the government on the income generated by a business or person. Accounting and journal entry for income tax is done in a distinct way for different types of business establishments i.e. Sole Proprietorship, Partnership, and Private Limited Company. Private limited companies […]

Liability – Accounting Definition In a business scenario, a liability is an obligation payable to a third party. It may or may not be a legal obligation and arises from transactions and events that occurred in the past. It is usually payable to an external party (e.g. lenders, long-term loans). There are mainly three types of […]

Liability A liability is an obligation payable by a business to either internal (e.g. owner) or an external party (e.g. lenders). There are mainly four types of liabilities in a business; current liabilities, non-current liabilities, contingent liabilities & capital. A liability may be part of a past transaction done by the firm, e.g. purchase of […]

Journal Entry for Manager’s Commission In addition to salaries, companies may offer a fixed percentage of their net profit to managers as commission. This is done to motivate and encourage them to generate more revenue for the company. Accounting and journal entry for manager’s commission involves the below 3 steps, Step 1 – Manager’s […]

Working Capital Turnover Ratio Working Capital Turnover Ratio is used to determine the relationship between net sales and working capital of a business. It shows the number of net sales generated for every single unit of working capital employed in the business. Companies may perform different types of analysis such as trend analysis, cross-sectional analysis, etc. to find […]

Types of Ledgers A ledger is a book where all ledger accounts are maintained in a summarized way. All accounts combined together make a ledger book. Predominantly there are 3 different types of ledgers; Sales, Purchase and General ledger. A ledger is also known as the principal book of accounts and it forms a permanent record of […]